Typewriters saw its end with the introduction of computers and so did the bicycles after motor vehicles. Is it time to see the slow death of financial mammoths called Development Financial Institutions (DFIs) and the rise of capital market and banks to replace them?

Post World War II, several countries nearly depleted with capital resources, struggling to develop their financial and labour capital, infrastructure. Banks with its limited expertise charged high premium for projects with large gestation periods could never meet the demands of these projects. This gave birth to special institutions called Development Financial Institutions (DFI) to act as a ‘gap-filler’ with the following mandate

- Providing medium and long-term assistance to business undertakings in the form of loans, underwriting and investment and fill the gap created by banks who confined to short term financing and selective investing and a poorly developed financial market

- Assisting new project ideas, undertaking feasibility studies, providing technical, financial and managerial assistance for the implementation of projects

Different countries have followed different objectives such as financing, promotion, building technical expertise for the functioning of DFI. Countries like Germany, Korea and Japan have transformed or devolved their DFIs after having attained the objective and with the better access to capital markets. India today is straddled with DFI under huge NPAs. This paper aims to establish that it is not only shrinking spreads and NPAs but more than that and the future of

DFI.

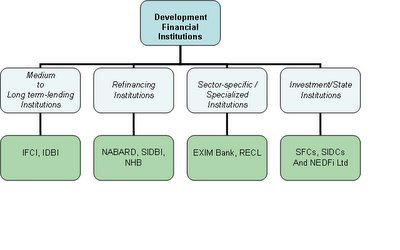

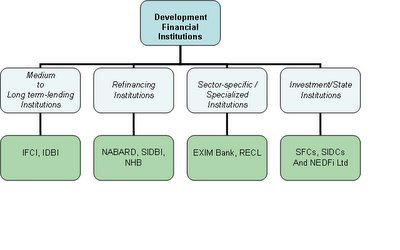

Looking back into its pastRBI was entrusted with the responsibility of building the success story of the DFI in our country. The Industrial Finance Corporation (IFCI) was the first special financial institution established in 1948 by an Act of the Parliament. This was followed with establishing State Financial Corporations (SFC) in 1951; currently there are 18 SFCs, ICICI in 1955, LIC in 1956, Agricultural Refinance Corporation (ARC), UTI and IDBI in 1964, RECL and HUDCO in 1969-70, 70, Industrial Reconstruction Corporation of India Ltd. (precursor of IIBI Ltd.) in 1971 and GIC in 1972. There are currently 52 institutions in this category.

Financial Health

Financial HealthThe classification to understand the financial health for the DFI has been done in two broad areas: FIs are regulated and supervised by RBI and FIs that are not under the direct purview of the RBI. IFCI and IIBI which have been operating as providers of direct assistance are all in poor financial health while refinancing institutions such as NABARD, SIDBI, NHB, EXIM Bank, IDFC have done really well in maintaining strong financials year on year.

The most inefficient among DFIs are State established SFCs. In states like Orissa, Bihar, TN, W Bengal, Maharashtra, Haryana and Gujarat, these institutions have eroded their entire networth and have neither been able to raise fresh funds nor service their debt requirements. The causes for the same have been explained in detail below.

The causes of decline in the 90s IDBI, ICICI and IFCI formed the triumvirate on which the country's project finance edifice rested. Of these, ICICI rapidly changed to face the challenges of the new competition while IDBI was forced to change when faced with huge losses. However, IFCI’s future is still undecided. A look into what caused their decline in the 90s will show the following reasons

Evolution of the Indian Banking SystemThe Indian Banking system is today well diversified with public, private and foreign banks competing for similar businesses. The expertise they have acquired to manage risks in extending finance to long term projects has reduced the need of DFI. The credit given by banks and DFIs as a percentage of GDP has increased from 3.9% in 1971-1992 to 4.3% in 1992-2000 .

Competition – A driving force for effective performanceUTI mutual fund today faces competition from more than 30 other mutual fund companies. LIC competes with Prudential ICICI, Tata AIG, Bajaj Allianz etc. In the long term financing, there has hardly been competition. Being monoliths, IFCI, IIBI and erstwhile IDBI had poor loan appraisal mechanisms, ineffective regulation leading to mismanagement.

Riding the Low Cost Advantage of banksBanks enjoy the natural advantage of having easy access to lost cost funds, a primary contention for DFIs. With RBI removing the LTO option for raising funds, DFIs were forced to raise funds from the market. DFIs are forced to lend to projects at rates that could make the loan unfeasible for them to service its cost of borrowing. The average cost of borrowing for SBI in 1997 was 6.3%, whereas the cost of borrowing for IFCI was above 10%. While the cost has reduced to 4.5% for the current year, it still remains the same for IFCI.

Poor asset distribution leading to NPA’sDFI had the following issues: High sector exposure , cyclical nature of business, limited checks with group and company, long term loans led to disproportionate asset distribution. SFCs, on the other hand had been extending term-loans to SSIs. They were burdened with high operational cost, poor assessing skills, and were extremely bureaucratic. It is estimated that they would require around 3600 crores of capital infusion to clean their balance sheet.

Indiscriminate disbursement of loansIDBI disbursement was growing at a rate of 14 per cent, ICICI at 27%, and IFCI at 20% since 1992-93 when the industrial growth in the country has stagnated around 3.5 per cent to 4 per cent indicating poor appraisal mechanisms.

Development of the Indian Capital marketOne of the primary objectives of DFI was to act as a ‘gap-filler’ in the capital market and help lending medium to long term loans. The resource mobilized in the capital market in the form of debt and equity as a percentage of GDP has increased from 0.6% in 1971-1992 to 1.7% in 1992-2000 .

OthersThe Public Undertakings Committee found SFCs

- Not following stipulated guidelines while sanctioning loans

- Lack of constant monitoring leading to misuse of funds

- Poor collection mechanisms

- Corruption and heavy sectoral exposure

- Political Interference

International Outlook on DFIInternationally, DFIs have had significant changes in their functioning over a period of time. There have been two distinct models followed:

- Anglo American: Market based which competed for resources

- Continental Europe and South East Asian Economies: Financial savings was diverted to these FIs for investment.

Of the four DFIs in Japan, one was restructured and the objectives realigned to meet social challenges and the rest went bankrupt and sold to private banks. Korea’s DFI has constant shifted to focus the requirements of its government. Singapore’s Development Bank of Singapore (DBS) now functions as a full fledged commercial bank.

Recommendations on the future of DFIGiven the importance of DFIs role in as a ‘gap-filler’, the following are the key recommendations and shall be discussed on the basis of classification

Refinancing InstitutionsNHB, SIDBI and NABARD can continue their status as a DFI till the existence of DFIs. However, they need to act as regulators for the section they are re-financing.

Sector Specific/Specialized InstitutionsNo changes are required to specialized institutions such as LIC, UTI, and EXIM bank etc. as they are competitive players and strong regulators. TFCI, National Co-operative Development Corporation and National Dairy Development Board should be converted to a NBFC and will be easier as they are profitable too .

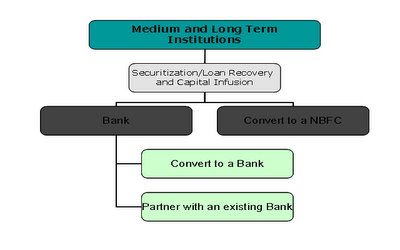

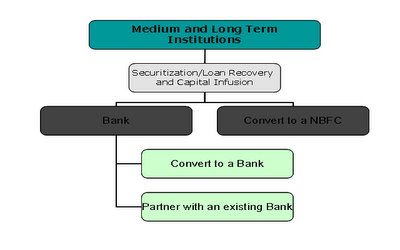

Medium to Long Term Lending InstitutionsBarring IDFC, IFCI, IDFC have shown heavy losses. The following are the options that are available for a turn-around.

Create an SPV or transfer them to IFCIs ARC Having completed this, the DFIs can be converted to a bank or an NBFC for the following reasons

- DFIs need to be given access to markets to raise low cost loans

- DFIs can cause systemic failures by not servicing their debt to insurance companies, pension funds. Hence, active regulation and portfolio monitoring will be needed from RBI.

- By deepening our debt market the dependency for DFIs will reduce

Devolving the system of DFI:

Converting them to banks or partnering with an existing bankThe success of ICICI’s conversion to bank and the recent make-over of IDBI to a bank but with a DFI status, gives a strong case for converting the existing DFIs to a bank. However, converting to a bank is not fraught without risks.

Partnering or Converting to a bank: A discussion

Partnering or Converting to a bank: A discussionEstablishing a bank will require

- Replicating an existing bank with no assurance of access to low cost deposits

- Longer Time requirement

- Heavy investment in technology

- Statutory requirements to be met with your current portfolio

Given these conditions, it is advisable for institutions such as IFCI or IIBI to merge itself to another bank than converting to a bank . RBI should allow these banks to raise long term loans through issue of ‘Development Bonds’ to fund the projects the DFIs have expertise in.

Converting into an NBFCIt would be ideal to see most of these institutions as NBFCs than DFIs as they can be regulated by RBI.

- Regulations can be relaxed on CRAR for profit making NBFCs of DFI nature .

- Active securitization of loans to help deepen the market.

- Compulsory investment from pension funds, postal savings in the lines of Korea.

- Diversification into wholesale banking including term finance, working capital finance, cash management services, equity to projects. Others include exposure to sector, group and individual companies.

State Financial Institutions - A stronger doseIn spite of commendable performance from Delhi SFC, APSFC (NPA’s currently at 16%) significant restructuring is imperative. The following are some of the key recommendations for SFCs.

Short Term SolutionConsolidate the bad portfolios of all SFCs and transfer to an SPV that works like in IFCI

- IDBI and SIDBI can restructure their loan exposure or convert them to equity. There would be a requirement of infusing close to 3600 crores from most states.

- An effective VRS , requiring close to 230 crores will be needed to reduce employee overheads that contribute 15-50% to less than 1-3% .

- Appoint a professional non-executive chairman with banking and finance experience and boards with experienced professionals, implement managementinformation system, adopt standard accounting practices and the EDIFAR should be updated with the defaulters list.

- Cross-sell other products and increase fee businesses.

- Prudent norms on exposure limits, in lines of banks, to specific industries must be established. Diversification of portfolio will ensure reductionof risk during adverse times.

Long Term solutionBanks have gained expertise in analyzing risk and have slowly started to increase their presence with in all segments including micro-finance . Given this current scenario SFCs have outlived their utility and should be phased out within a definite time frame. However, changing to a bank in the long run would be difficult. The opportunity should be constantly monitored and converted to a bank or an NBFC that can absorb the SFCs without affecting its statutory requirements.

ConclusionDFIs had been the cutting edge of the Indian financial system and enjoyed high credibility as a more than being a ‘gap-filler’ .Recent losses with IFCI, IIBI, SFCs has changed the scenario. However, barring these few DFIs, others such as NABARD, SIDBI, NHB, and IRFC have done exceedingly well. However, the need has come to address these losses and look at the future of these institutions.

The government of India cannot escape from its obligation to bail out the sick DFIs. As long as the present legal structure makes it difficult to force delinquent borrowers to pay up, DFIs may have no option but to look up to the government. It can be argued that the current problem of NPAs of DFIs is itself partly the result of the acts of omission and commission of the government. It goes without saying that the long term remedy to the DFIs’ problem lies in the

development of the debt market.

Converting them to a bank, that have gained the expertise of strong loan appraisal mechanisms, cheaper source of credit, better collection systems and active monitoring of disbursals and regulatory check would be more appropriate for the future of DFIs. However, it should be at the discretion of the DFIs. Active securitization, allowing long term development bonds, diversification, sectoral caps will further benefit by removing systemic shocks. It is much more than a combination of shrinking spreads or rising NPA’s that gets addressed.