May 30, 2006

Allcargo Global IPO

The company is involved in logistics and has quite a history in this field. However, you will see that the company has used a few paragraphs repeatedly throughout the prospectus. In the first instance it was unnecessary as any person who is reading the first section will remember what he read and even if he does forget, a simple remark of the page would have done so. However the company insists on repeating forcing the reader to re-read. Anyways, writing a prospectus seems to be an art which ENAM is yet to master and I shall hopoefully not delve on this issue any longer.

What I liked of the company was the prospects of the industry. Again the company's will be extremely dependent on the infrastructure that the government needs to invest in. However, given the fact that considerable investment is being done by the government atleast in the improvement of ports, this company is promising to deliver something that is achievable.

The pricing is also comfortable. It recently had placed a part of the equity to outsiders at similar prices hence making the company slightly more reliable. However, the company's promoters loved to juggle their shareholding at extremely cheap prices. A share that the company's promoters should have sold for atleast Rs.350 was sold for Rs.10. Also the company has given stock options at Rs. 10 which can be exercised in the near future. However, this will not dilute the stake as it marginal in nature and would not affect the profitability when charged to the income statement.

The investment proceeds will be used for building infrastructure for the company in certain regions such as Chennai. Also, the money will be used to pre-pay debt. This is something I was not comfortable as the cost of the loan is only 11%. The company has strong cash flows and could have used that to re-pay the loan. However, this is the company's decision.

Anyways, the company has fairly valued its stock and do not know if it provides reasonable appreciation. However, when one compares to its peers, it looks there is some. Time would be the judge for this. Investing would be ideal for a period of 3 years, is my best estimate. Why 3 and not 5? Coz I am a long term investor, and prefer 3 over 5.

Reading a Prospectus

Obviously not everything is interesting and you can comfortably skip about 50-75 pages. However, the rest of the pages are interesting as they always give a wonderful picture of the company and the industry. It always tries to give you a feel that this is the company that will give you a 'ten bagger' or atleast a 'five bagger' (A 'ten bagger' is a term used for companies whose share price moves by 10 times, a term borrowed from one my gurus, Peter Lynch).

Most prospectus follow similar pattern of reading. This is extremely useful as one knows when to skip pages. I do not have any interest reading the general risk factors, endless repition of financial statements (which I shall comment upon later), statutory disclosures etc. We all understand that cigarettes are injurious to health yet it still does not prevent the smoker from enjoying his five minutes of absolute freedom.

Anyways, I enjoy reading certain specific sections of the prospectus. First, the industry - gives a wonderful picture, as always, the growth prospectus, how India is always in deficit of these basic requirements, commitments from the government (which I do not know if it will be implemented) to improve them which will be repeated from infinite number of times, outsourcing that will always happen to India and nowhere else. While it sounds pessimistic, I enjoy these statements because it tells me there is so much scope to improve in the country. Developed countries would face this biggest concern-the reason for government to spend hufe amounts of taxpayers money. India, being deficit in almost every area, has no problems. Outsourcing is a reality and cost savings are huge for companies. So, every prospectus reinforces the same issues.

The second part I enjoy reading is the company's prospects to grow in the near future. Most of them tend to be leaders in their category and almost all of them are planning to grow more than industry average. I do not know how everyone is growing at above industry average. However, this statement is something that one sees and cant help laugh at it.

The final part is the capital structure and what it intends to do with the money. This part is significant and it helps me to understand if the company is interested in building wealth to the shareholders. I like companies that repay its debt, however as far as it is above the cost of equity. As interest rates are low and most companies are 'leaders' in their industry this can't possibly happen. However, most companies seem to be expanding their capacities. Scalability will be important as companies can play with their cost structures effectively and hence gain advantage on pricing. What is most concerning is the kind of allotments the company has made in the past to its shareholders. Focus IPO for instance alloted at a steep discount to its preferential holders a year back but where charging the new investors thrice the comaparable cost. A comfortable exit option to the existing shareholders. I like reading the section that deals on civil and criminal suits against the company. Deccan Aviation tops this list. The suits against the company ran to three - four pages and it was fun reading the reports. This section is important as it shows light on the quality of management. However, the number of complaints is related to the industry, as a company that is in the end of the value chain is bound to face more. Directors of the company and their profiles is another good area of reading. Again Deccan Aviation tops in this. One of their directors is a director of 52 other companies too. If every company keeps atleast 5 board meetings a year, he will spend most of his official days just from one board room to the other. Something has to be done on this issue. You can't have directors, who are meant to safeguard shareholders interest being a director in so many companies. However this is India and as I said earlier, huge scope for improvement exists.

Finally and most importantly the current balance sheet, profit and loss and cash flow statements. This is something you will see frequently in the prospectus. Comany's projection seems to be there on every page of the prospectus, ( exaggerated but cant help myself). Yet reading this gives me an idea on whether to invest or not. Well, what I do like about these IPOs are that they do meet their projections in the near future once they are listed. As I do not track most of these companies post their issue, I do not know what has happened to their projections. My guess is that they should have met them as the stock markets seems to be quite embarrassed to list IPOs at par and most of them have done well even past a few quarters after their listing.

Currently I am reading a prospectus on Allcargo. Lemme see what fun this prospectus beholds to the reader.

May 29, 2006

Prime Focus has come out with an IPO from May 25th -May 31, 2006. An interesting IPO coming from a sector that seems to be doing well-the entertainment sector. The company's performance has been stunning. The sales has grown by 60%-80% CAGR across three years. The PAT has shown even better performance. The company decided to price the issue at trailing PE of close to 50 on the lower side and updwards 70 on the higher side. Considering the performance and the future plans of the compny, it looks like the share price is fairly or slightly over-valued. My problem is not on the price of the issue but on this table that was in the offer document.

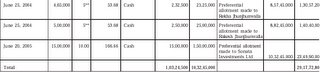

I do not know if the above image is clear or not. It shows three transactions, preferential in nature, made by the company to Rakesh and Rekha Jhunjunwala, and one company Sonata Investments. Rakesh and Rekha got the shares of the company at close to Rs.66 in June, 2004 and Sonata got the same shares at Rs.166. I have no problems on the pricing of these issues, though I am disappointed that the former two got the company at really attractive prices - a P/E of less than 17. Sonata Investments got the same shares at slightly above 17. While these two investments is reaping them enormous returns, the poor shareholder of the current issue, will be forced to wait for a long time to get the returns that these three investors are enjoying. If this is what one calls "Angel Investing" or Venture Capital Investments, then it surely looks like they robbed the company blind.

The fresh investors do not have to worry too much either. The company has a wonderful option for them. The IPO has the stablisation scheme for a period exceeding not more than 30 days. A simple scheme wherein the director has 'loaned', if I could use that word, to the book runners. They shall 'ensure' that the price does not fall below the issue for this period. So, the investor is atleast 'reasonably' assured of downside protection.

Yet, for a company that seems to have done well, atleast on paper, with strong cashflows, it seems to be a letdown on pricing. However, we are on a bull market and we have funds that invests in IPOs. Hopefully, they shall bring some upside to the stock.

May 24, 2006

I have always enjoyed crashes in the past. I enjoyed the stock markets around 2000 when everyone was excited seing sensex touching 6000. Balloons were flying around BSE to mark the fresh high. I loved seeing this crazy act by brokers, who are otherwise meant to be silent and unknown to the rest of the world. And then it happened, the inevitable or the truth prevailed as the Sensex crashed and it was the start of a long period of consolidation. I started investing at 3800 levels. What more exciting would it be to see the Sensex fall further to 2900 before the reversal actually start. Each time it fell, each time I would 'buy'. As a small investor, I feared that the stock markets would actually reach an all time high before I could invest my surplus money completely. This was my learning during the times it fell.

Things took a totally different turn this time around. Today I do not have surplus money to invest, I took money out of my treasure chest, close to 10% of my portfolio, which I always keep it liquid money, waiting for an excellent occasion to invest. I thought that day was last week and so I started investing in a stock that fell by 10%. It fell the next day by another 10%, I thought this was an amazing bargain and I invested further. Atleast, one thing I learnt was to always build a portfolio of stocks slowly. There is always time in this market to make money. But to my utter dismay, the crash occured on monday, and god it was one hell of a crash. I saw this stock fall by an amazing 20% in about two hours. Well, to compound this, the stock fell again the next day when most stocks were moving up. One of the "Blue-chip" ones that is beating me black and blue. But then that is life.

I tried to analyse if I made a mistake in my buying process. Not too many mistakes, but yes there were a few. The stock was pretty expensive but comparitavely cheaper than its peers. A leader in its field with business in India and outside. Well lets see what the future holds for this stock.