Prime Focus has come out with an IPO from May 25th -May 31, 2006. An interesting IPO coming from a sector that seems to be doing well-the entertainment sector. The company's performance has been stunning. The sales has grown by 60%-80% CAGR across three years. The PAT has shown even better performance. The company decided to price the issue at trailing PE of close to 50 on the lower side and updwards 70 on the higher side. Considering the performance and the future plans of the compny, it looks like the share price is fairly or slightly over-valued. My problem is not on the price of the issue but on this table that was in the offer document.

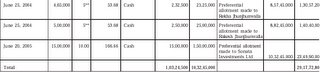

I do not know if the above image is clear or not. It shows three transactions, preferential in nature, made by the company to Rakesh and Rekha Jhunjunwala, and one company Sonata Investments. Rakesh and Rekha got the shares of the company at close to Rs.66 in June, 2004 and Sonata got the same shares at Rs.166. I have no problems on the pricing of these issues, though I am disappointed that the former two got the company at really attractive prices - a P/E of less than 17. Sonata Investments got the same shares at slightly above 17. While these two investments is reaping them enormous returns, the poor shareholder of the current issue, will be forced to wait for a long time to get the returns that these three investors are enjoying. If this is what one calls "Angel Investing" or Venture Capital Investments, then it surely looks like they robbed the company blind.

The fresh investors do not have to worry too much either. The company has a wonderful option for them. The IPO has the stablisation scheme for a period exceeding not more than 30 days. A simple scheme wherein the director has 'loaned', if I could use that word, to the book runners. They shall 'ensure' that the price does not fall below the issue for this period. So, the investor is atleast 'reasonably' assured of downside protection.

Yet, for a company that seems to have done well, atleast on paper, with strong cashflows, it seems to be a letdown on pricing. However, we are on a bull market and we have funds that invests in IPOs. Hopefully, they shall bring some upside to the stock.

No comments:

Post a Comment